marin county property tax exemptions

Overall there are three stages to real estate taxation. This would result in a savings of approximately 70 per year on your property tax.

Claim for Reassessment Exclusion for Transfer Between Grandparent and Grandchild on or.

. Your property taxes would remain at 3500 instead of the new rate of. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

Veterans Exemption Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home. To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors. 32 rows Change of Ownership Statement in Case of Death.

For example the property taxes for the home that you have owned for many years may be 3500 per year. Ad Find Marin County Online Property Taxes Info From 2021. Receive Marin County Property Records by Just Entering an Address.

The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities. Marin County reports 84 rise in. The final levy for the Measure A parcel tax will be for the 2034-2035 tax year.

County Library Special Tax Senior Exemption - 5756 Parcel Tax 1994 - Measure K L. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70. Establishing tax levies estimating property worth and then receiving the tax.

The Assessment Appeals Board. The individual districts administer and grant these exemptions. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

Who voted for this. To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single. Qualifying for Senior Exemptions.

This collection of links contains useful information about taxes and assessments and services available in the County of Marin. This collection of links contains useful information about taxes and assessments and services available in the County of Marin. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

The Measure A parcel tax has a term of 20 years commencing in the 2015-2016 tax year. Transfer tax in Marin County is a tax imposed by California counties and cities on the transfer of the title of real property from one person or entity to another within the. The Assessment Appeals Board.

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Marin County collects on average 063 of a propertys assessed. Owner must be 65 years old or older by.

Not yet posted but upcoming soon is information for filing for a low income senior exemption for the new Marin Wildfire Preparedness Authority parcel tax which is. The individual districts administer and grant these exemptions. Exemptions are available in Marin County which may lower the propertys tax bill.

The Marin County Assessor co-administers the exemptions with the California State Board of Equalization. Taxing units include city county governments and various. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you.

Would levy a tax of 26 per 100000 of assessed property-tax value. 1 day agoSenior citizens and low-income residents can apply for exemptions. If you have any questions about the Measure A - County Library Special Tax Senior Exemption andor Measures K L - Senior Low-Income Exemption please call the Library Administration.

Cook County Assessor S Office What Is A Certificate Of Error Facebook

San Diego County Ca Property Tax Search And Records Propertyshark

Prop 19 And Property Taxes In California Marc Lyman

Marin County Mails Property Tax Bills Seeking 1 26b

Cook County Assessor S Office How To File An Online Appeal Facebook

Property Tax Bills Arriving In Mailboxes Soon

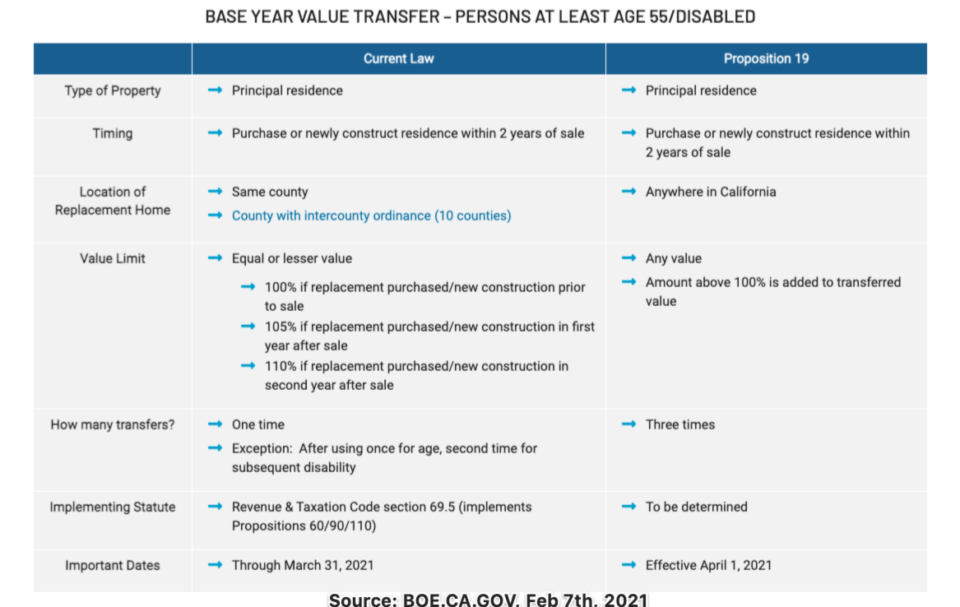

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Title Wave New England Marine Title Newsletter Marine Documentation Services

First Installment Of Property Taxes Due Dec 10 In Marin County San Rafael Ca Patch

Transfer Tax In Marin County California Who Pays What

/cloudfront-us-east-1.images.arcpublishing.com/dmn/ECVSORGTVFCXXJ4C35OIUL45AI.JPG)

Dear Californians And Other Texas Newcomers Here S The Skinny On Your Tax Bill

What To Know May 16 Deadline To Protest 2022 Residential Property Tax Appraisals

What Is A Homestead Exemption California Property Taxes